Gundlach’s Three Investments to Avoid

Diversify equities outside the U.S., urged Jeffrey Gundlach, and avoid two products that have become very popular among retail investors.

Diversify equities outside the U.S., urged Jeffrey Gundlach, and avoid two products that have become very popular among retail investors.

Gundlach spoke to investors via a webcast, which he titled “Surreal,” and the focus was on his flagship total-return fund (DBLTX). Slides from that webcast are available here. Gundlach is the founder and chairman of Los Angeles-based DoubleLine Capital.

I will come back to Gundlach’s investment recommendations, but let’s first review his thoughts on the economy and markets.

The title of his webcast was taken from a sculpture by Maria Sol Escobar (popularly known as “Marisol”), who in her heyday in the 1960s was more famous than Andy Warhol. Her sculpture below, titled Magritte II, was an homage to paintings by Rene Magritte, a prominent surrealist painter.

Throughout his presentation, Gundlach cited several market and economic patterns that were “surreally divergent” from the period of secularly declining interest rates that lasted from approximately 1980 to 2020.

Recession signals abound

As in previous webcasts, Gundlach showed that the two-year Treasury yield presages the changes by the Fed to its funds rates. The market is predicting a couple of cuts this year, he said, and Gundlach does not expect more than that in 2025.

“The Fed is not going to cut next week,” he said. Moreover, according to Gundlach, the Fed acknowledged that “it doesn't know what is going on,” Gundlach said.

Long-term Treasury yields increased since 2022, creating 50% drawdown on the 30-year price. The 30-year Treasury yield was about 4.9% in June 2025, roughly double its level in early 2022. Over the 10 recessions in the 1980s and 1990s, the drawdowns of the Bloomberg U.S. Aggregate Bond Index (AGG) have lasted 9-12 months. But recently it has been 58 months – almost five years – since the bond market reached it last peak in August 2020. That is a natural byproduct of the end of secularly declining interest rates.

Interest rates are higher globally since 2022, even in Japan, where 30-year rates recently hit 3.2%, a record high.

Outside of Treasury bonds, corporate and MBS spreads are close to where they were at the end of last year. One exception is CCC loans, where spreads have tightened. This is an anomaly, according to Gundlach, because defaults on those loans have risen recently.

There is a “credit-cycle problem” in the spread between CCC and BB bonds, he said. That spread has risen this year and it is above its moving average, which signals stress in the corporate bond market.

The yield curve, based on the 2-10-year spread, is normally correlated with the U3 unemployment rate. But U3 is rising and signals a weakening employment market.

When unemployment, as measured by U3, crosses its 36-month moving average, it normally signals a recession. That has not happened, but he said it is “sensible” to think that it will happen as U3 rises.

The leading economic index (LEI) is another example of surreal data, according to Gundlach. Normally, when the LEI goes negative, there is a recession, but that has not happened. The LEI data is distorted from the aftereffects of the pandemic. “A lot of statistics have this volatility,” he said, and their signals are no longer working.

One very concerning development is the yield curve steepening before a recession. It is not merely a yield-curve inversion that leads to a recession; it is the subsequent de-inversion. That has happened with the 2-10-year spread at a positive 50 bps. That de-inversion has nearly always happened at the “front end of a recession,” he said.

Tepid inflation

Inflation will end the year at around 3%, but that depends on the path of the tariffs.

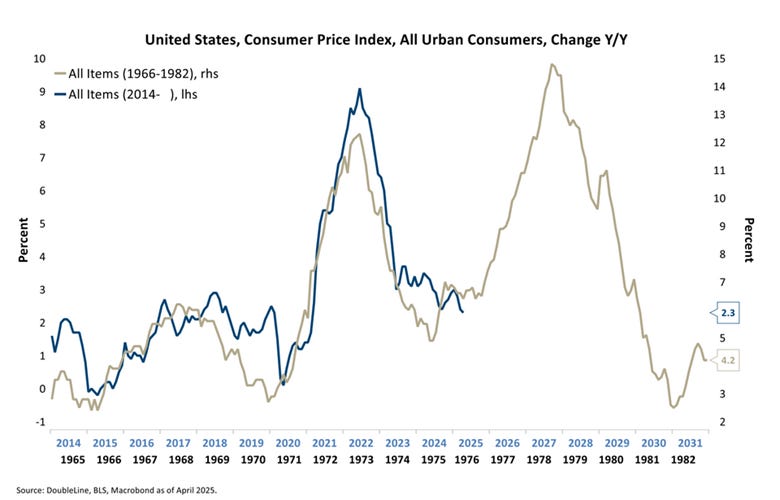

The headline CPI is 2.3% and core is 2.8%, which he said should make the Fed happy. The PPI readings are at similar levels, and the headline PCE is 2.1% and core at 2.5%. “But I think they are going to go higher as we move toward the end of the year,” Gundlach said.

Export prices are up 2% year-over-year, and import prices were effectively unchanged.

Gold is up 25% year-to-date, but broad commodities are unchanged. Energy prices are down, with WTI at approximately $60/barrel, down from roughly $85–90 a year earlier.

Using data from Apollo research, he showed a chart of 1970s inflation superimposed on data from three years ago.

Gundlach said this pattern is “surreal” in that the two paths are virtually identical. If that pattern persists, which Gundlach did not predict, inflation will spike and be “off to the races.”

The weakening dollar

The dollar has weakened this year, which Gundlach predicted and is consistent with the economy weakening. “I think the dollar will continue to go down,” he said. “It could take out the previous low on the DXY (“Dixie” trade-weighted dollar index) of approximately $72 in 2011.”

This is unusual; the DXY has strengthened during market corrections over the last 15 years, acting as a safe-haven asset. This is a “regime change,” Gundlach said. Similarly, the dollar has historically tracked the yield on the 10-year Treasury. That relationship broke down at the start of 2025, when the dollar went down and the yield rose.

“As the economy weakens,” he said, “the dollar will go down and yields up.”

Usually when the Fed cuts rates, the 10-year yield falls. But the path of the 10-year yield is way below the median pattern following previous Fed cuts. The yield on long-term Treasury bonds will go up, he said, following cuts.

Below is what Gundlach called the chart of the year”:

It plots the budget deficit as a percentage of GDP against the unemployment rate. The black dots are from 1960-2017, when U3 was low and there were low deficits, and vice versa. The red dots are from 2016-2024 and show a “completely surreal relationship,” Gundlach said. There is historically low unemployment and high deficits relative to GDP.

For example, FY2024’s deficit was roughly $1.8 trillion (≈6.4% of GDP), well above the 50-year average (~3.8%).

In 2001, the CBO predicted that the deficit would change from surpluses of 2% to 5.5% in 2012. Instead, we went to a deficit during the global financial crisis of approximately 10%. The CBO was off by 12%.

During the current expansion, the deficit has been 7% of GDP, and it will get worse during the next recession, Gundlach said. This follows the pattern of deficits after the 2007-2008 and 2020 recessions, which were more extreme than in prior recessions. These statements align with budget forecasts (CBO projected ~6.2% in 2025 and about 6.4% in 2024.

He described as “absolutely surreal” data that showed that the issuance of couple bonds is the same as the absolute height of money printing during the response to the recession:

Tariffs offer “some potential relief” from budget problems, he said. Tariffs were generating revenue of approximately $50 billion/month a year ago and are now $100 billion.

Investment takeaways

Throughout the presentation, Gundlach’s core advice was clear: Look abroad for growth and avoid crowded U.S. trades.

“The trade is to own stocks in the rest of the world. Europe and the emerging markets are outperforming the S&P 500 because the dollar is in the beginning of a secular decline, he said.

Approximately 15 years ago, there was $3 trillion in foreign investments in U.S. securities; that number is now $25 trillion. If that is reversing, and foreigners are selling US. holdings, there will be a lot of pressure on U.S. stocks.

It is perfectly sensible to invest in the emerging markets, and Gundlach likes India and southeast Asia, Mexico and Latin America. Germany might be a good idea because it is re-industrializing and stimulating its economy.

Do not buy long bonds if you are worried about economic weakness, according to Gundlach. If he were running the government, he said he would be scared if interest rates rose to 6%. In that case, the yield curve would steepen a lot, and we could see quantitative easing (QE) again.

You are better off owning gold if you are worried about weakening, he said.

Avoid bitcoin ETFs. When you see an asset class introduced as a retail offering, it is after its outperformance. Asset managers claim they are giving wonderful opportunity to retail investors, Gundlach said. But past performance is no guarantee of the future.

“You are basically chasing momentum,” he said. “When Individual investors do this, it is the end of the momentum cycle.”

The same issue is happening with private credit, according to Gundlach. While private credit has performed admirably over certain periods in the past five years, it is no longer demonstrating outperformance. It is an illiquid asset class put into a daily NAV fund, and there is a mismatch in liquidity.

“That is something to always avoid,” Gundlach said.

Robert Huebscher was the founder of Advisor Perspectives and its CEO until the company was acquired by VettaFi in 2022. He was a vice chairman of VettaFi/TMX until April 2024.

Thanks, Andy. I thought about writing about bitcoin and private credit ETFs, but there are already a lot of good articles explaining why these are a bad idea.

Great as usual Bob--funny that 2 of Gundlach's DON'T BUYs are the hottest retail trends. Isn't that always the way it ends...