High Profile, Low Returns, and the Reality of Celebrity ETFs

Does fame breed fortune for investors in ETFs backed by big-name celebrities?

Celebrities from television, finance and politics have increasingly entered the world of exchange-traded funds (ETFs), attaching their names and reputations to actively managed investment products. From Kevin O’Leary, the “Shark Tank” personality, to Vivek Ramaswamy, a biotech entrepreneur turned political candidate, these prominent figures are betting their fame can fuel fund flows.

But does star power translate into investment performance?

O’Leary became known as “Mr. Wonderful” on the “Shark Tank,” and Ramaswamy was a candidate for the Republican presidential nomination in 2024 and is now running for governor of Ohio. O’Leary founded O’Shares, a provider of indices that support ETFs, and Ramaswamy founded Strive Asset Management, an ETF provider. They are joined by a handful of others who have used their prominence to create and promote ETFs.

I evaluated the performance of these celebrity-backed ETFs from two angles.

How did they perform relative to similar ETFs? To answer this question, I looked at how they performed in their Morningstar peer groups.

Second, how did they perform relative to a passive alternative? I asked this question since many investors will adhere to a strictly passive, indexed approach, owning market-cap-weighted index funds. The ETFs offered by these providers are active investment products. My goal was to determine the opportunity cost of taking an active approach versus a passive, indexed approach.

Overall, most of these ETFs matched or lagged the median of their respective peer groups. On average, the products underperformed their passive alternatives.

This analysis does not consider survivorship bias. As I note below, one celebrity ETF (PP) has already been delisted. There may have been others. These results would be worse if they accounted for the ETFs that were shuttered or merged because of poor performance.

Let’s look at each of the celebrity ETFs.

Kevin O’Leary and O’Shares

O’Shares, co-founded by O’Leary in 2015, was acquired by ALPS Advisors in 2022. O’Leary continues to serve as its chairman. It provides four indexes (and ETFs sponsored by ALPS) that are based on factors such as profitability, dividend growth and revenue growth.

Here is how these products fared in their Morningstar peer groups:

Three of the four ETFs were in the bottom half of their peer groups, and the average was the 63.8th percentile.

Here is how they performed relative to a passive investment:

All four ETFs have underperformed a passive benchmark (the ETF SPY, a proxy for the S&P 500). The average underperformance was 472 basis points.

Vivek Ramaswamy and Strive Asset Management

Ramaswamy cofounded Strive Asset Management in 2022 with a mission to “maximize value through unapologetic capitalism.” He resigned in February 2023 to pursue his presidential candidacy. Initially branding itself as “anti-woke,” the firm emphasized a rejection of ESG-based investing. It has since toned down that focus and now engages companies through proxy voting and advocacy.

Here is how its products fared in their Morningstar peer groups:

Four of the 10 ETFs were in the bottom half of their peer groups, and the average was the 53rd percentile.

Here is how they performed relative to a passive investment:

Five of the 11 ETFs outperformed a passive benchmark, and the average was an underperformance of 119 basis points. STRV stands out as a passive, market-cap-weighted index fund – unlike the rest of Strive’s lineup; it still underperformed SPY by 40 basis points.

Other celebrity ETFs

A handful of celebrities are behind individual ETF products.

Nouriel Roubini, known as "Dr. Doom" for forecasting the great financial crisis, is an NYU professor. He launched the Atlas America Fund (USAF). It is designed to invest in companies that “underpin the U.S. economy.”

Dan Ives is a prominent technology and AI analyst. He has leveraged his expertise to launch the Wedbush AI Revolution ETF (IVES). It seeks exposure to companies at the forefront of the artificial intelligence (AI) revolution.

Tom Lee is a co-founder of Fundstrat and a former JPMorgan equity strategist. He launched the Granny Shots US Large Cap ETF (GRNY). The fund invests in U.S. large-capitalization equities. The term "granny shot" refers to an unconventional basketball free throw style. It represents Fundstrat Capital's “unique research process.”

Dave Portnoy is the founder of Barstool Sports. He promoted the VanEck Vectors Social Sentiment ETF (BUZZ), which aims to hold stocks that are popular on social media.

Kevin Paffrath is a popular YouTuber and financial adviser. He launched the Meet Kevin Pricing Power ETF (PP). It was delisted on 2/25/25.

Here is the performance of those products compared to their Morningstar peer groups:

All ETFs performed in the top half of their peer groups, and the average was the 14th percentile. But there is relatively little history for these ETFs.

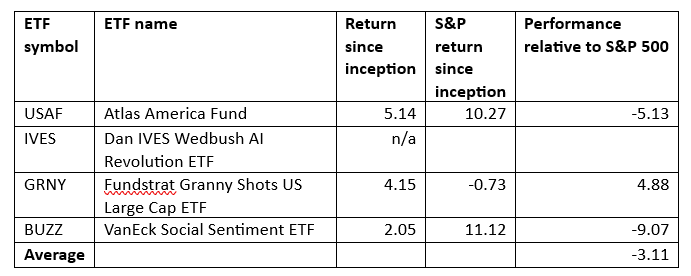

Here is how they performed relative to a passive benchmark:

One of the three for which performance data is available outperformed the S&P 500. The average of the three was an underperformance of 311 basis points.

Should investors back celebrity ETFs?

Investors should resist the lure of celebrity branding when evaluating ETFs.

But, in fairness, this probably has nothing to do with the fame of the individual behind the product. The problem is that these are active products (except for STRV) that carry expense ratios much greater than 0.09% for SPY.

Several of these ETFs emphasize dividend strategies (e.g., OUSA, OUSM, OEUR, and STXD). I have looked at this product category previously and showed that these were inferior to cap-weighted index funds. I have also examined thematic ETFs (e.g., OGIG, FTWO, DRLL, SHOC, USAF, IVES, GRNY, and BUZZ) and showed that only a small percentage delivered acceptable results. The same lackluster performance was true of smart-beta products (e.g., STXG and STXV).

Active ETFs – particularly those with elevated expense ratios – struggle to compete against low-cost index funds. Whether backed by celebrities or not, these strategies often fail to justify their fees. Investors should approach them with rigorous scrutiny and a healthy dose of skepticism.

Robert Huebscher was the founder of Advisor Perspectives and its CEO until the company was acquired by VettaFi in 2022. He was a vice chairman of VettaFi/TMX until April 2024.